Let Us Show You How! (716) 580-3773

Medicare

Medicare can be puzzling. Even though Medicare is the nation’s largest health insurance program, most people don’t know what Medicare covers or how much it costs. If you are already 65 and on a group plan, or you would just like to learn more about the benefits available, this guide will provide you with basic information to help you make an informed decision about your healthcare needs. Medicare is also available to qualified disabled individuals under 65 who are entitled to Social Security Disability Insurance.

There are several Medicare options available to help meet the unique needs of every beneficiary.

Medicare is the federal health insurance program for :

Generally, Medicare is for people 65 or older. You may be able to get Medicare earlier if you have a disability, End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant),

or ALS (also called Lou Gehrig’s disease)

HOW TO APPLY FOR MEDICARE:

You can apply for Medicare by contacting Social Security

1.Online

It’s the easiest and fastest way to sign up and get any financial help you may need. (You’ll need to create your secure my Social Security account to sign up for Medicare or apply for benefits.)

2. By Phone

TTY 1-800-325-0778

3. In Person

Visit www.ssa.gov to find your local office

1. Online

It’s the easiest and fastest way to sign up and get any financial help you may need. (You’ll need to create your secure my Social Security account to sign up for Medicare or apply for benefits.)

2. By Phone

TTY 1-800-325-0778

3. In Person

Visit www.ssa.gov to find your local office

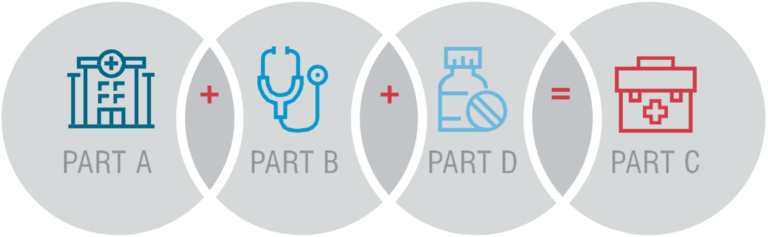

ABC'S OF MEDICARE

Part A can be explained in the simplest terms as hospital insurance

Hospital Insurance

- Inpatient Hospital Care

- Skilled Nursing Care

- Home Health Care

- Hospice Services

Part B provides outpatient coverage

Medical Insurance

- Doctors Visits & Preventive Care

- Outpatient Care

- Durable Medical Equipment & Supplies

- Imaging & Lab Test

- Surgeries

- Chemotherapy & Radiation

Plans offered by private insurance companies

Medicare Advantage Plans

- Cover what Medicare A & B Cover

- Can include Prescription Drug Coverage

- Some include vision, dental & hearing

- No Medical Deductibles

- Urgent & Emergency care covered worldwide

- Has an out of pocket maximum

Prescription Drug Coverage

- Helps cover the cost of prescriptions drugs

- Can purchase part D through a Medicare advantage plan or a stand alone drug plan

Part D - Prescription Drug Stages

DEDUCTIBLE STAGE (IF APPLICABLE):

You pay 100% of the cost of your prescriptions until the deductible is met.

INITIAL COVERAGE STAGE:

You pay the co-payment/coinsurance and your insurance plan pays the remaining share

COVERAGE GAP:

You will pay 25% of your prescriptions drugs(brand & generic, until you reach the True out-of-pocket maximum).

CATASTROPHIC COVERAGE STAGE:

You will pay $0 copay / coinsurance

• Medicare Drug Stages begin on January 1st and go through December 31st of each plan year

• True Out-Of-Pocket Cost (TrOOP)- what your total out of pocket expenses are during all stage.

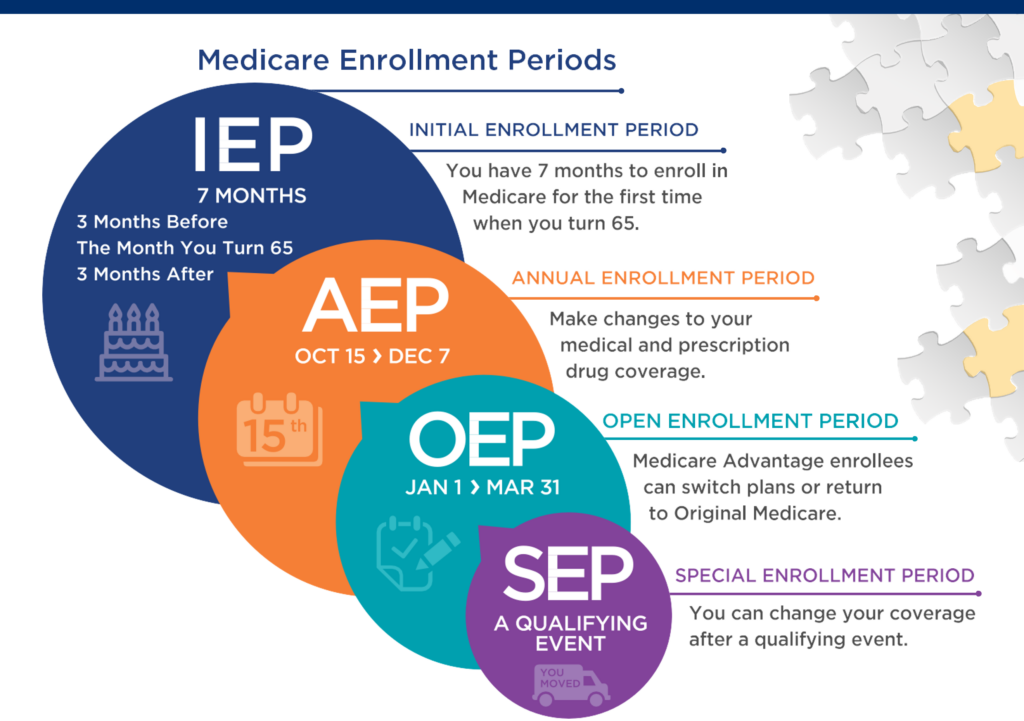

Part B late enrollment penalty

- Generally, you won’t have to pay a Part B penalty if you qualify for a Special Enrollment Period. Learn more about Special Enrollment Periods.

- You’ll pay an extra 10% for each year you could have signed up for Part B, but didn’t.

- You may also pay a higher premium depending on your income.

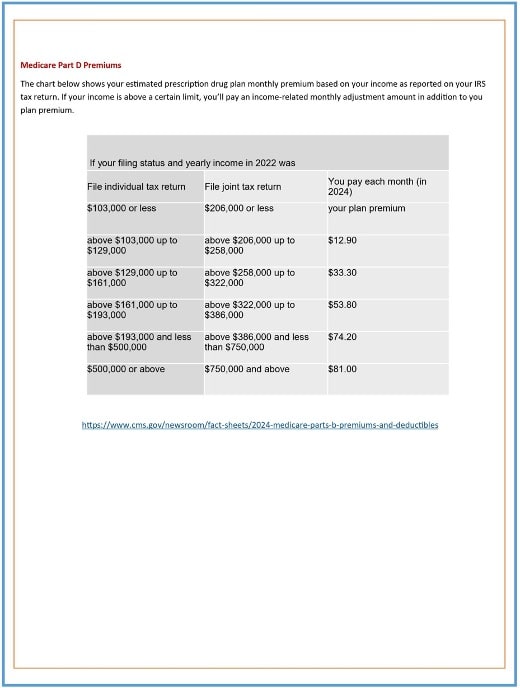

Part D late enrollment penalty

You’ll pay an extra 1% for each month (that’s 12% a year) if you:

- Don’t join a Medicare drug plan when you first get Medicare.

- Lapse in coverage for more than 63 days

Frequently Asked Questions

1. Do I have to enroll in Medicare, I'm still working?

If you are actively working and receiving benefits from your employer and there are more then 20 employees you do not need to enroll in part B until you retire.

2. How much will Medicare cost me?

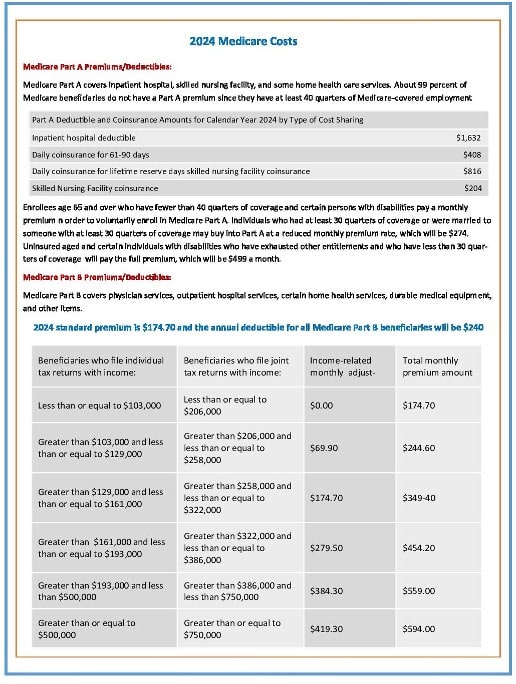

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts affect roughly 7 percent of people with Medicare Part B. The 2021 Part B total premiums for high-income beneficiaries are shown below.

3. What does Medicare cover?

Under part A Medicare covers inpatient care, home health care & hospice care. Medicare part B covers outpatient services, doctors, labs, x-rays, etc.

4. Can you explain the coverage gap?

There are different phased in the prescription program. Phase one, is where you pay the plan deductible is there is one, Phase two, you pay the plan copays until your total drug cost reached the initial coverage limit. Phase three- the coverage gap is where is you pay 25% of all medication until you reach the out of pocket maximum. Phase four is catastrophic coverage where you will pay no more than 5% for the copay.

5. Why do I have to pay for part B if I'm enrolling in another plan?

By paying your part b premium the health insurance you choice will get a monthly subsidy to help off set the cost of your plans premiums and copays.